Table of Contents

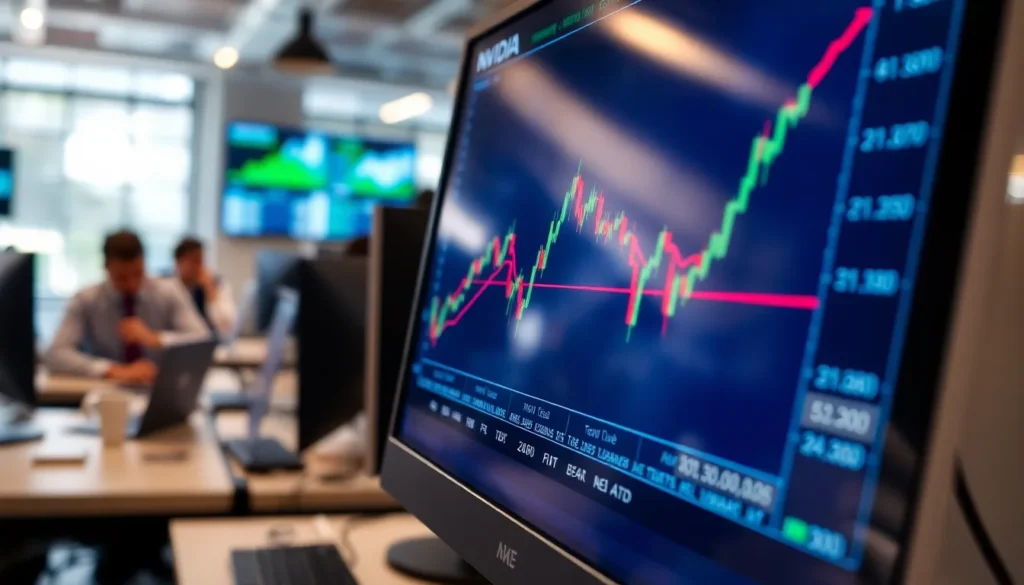

ToggleIn the fast-paced world of tech stocks, keeping an eye on NVIDIA’s 50-day moving average is like having a crystal ball—minus the fortune-telling hat. This powerful indicator smooths out price fluctuations, helping investors spot trends and make informed decisions. It’s the secret sauce that can turn a casual observer into a savvy market player.

But why should anyone care about this seemingly boring metric? Well, it’s not just numbers on a screen; it’s a glimpse into NVIDIA’s performance and potential. Whether you’re a seasoned trader or just looking to dip your toes into the stock market, understanding this moving average can give you an edge. So buckle up and get ready to dive into the world of NVIDIA’s 50-day moving average—where data meets opportunity, and maybe a little bit of magic happens along the way.

Understanding Nvidia 50 Day Moving Average

Nvidia’s 50-day moving average serves as a vital tool for assessing the stock’s performance. This metric averages the closing prices over the last 50 days, providing insight into short-term price trends. Investors base their decisions on this average, as it minimizes the impact of daily price volatility.

The moving average helps signal potential buy or sell opportunities. When Nvidia’s stock price exceeds the 50-day moving average, it often indicates bullish momentum. Conversely, if the price falls below this average, it may suggest bearish sentiment.

Traders frequently use this indicator in conjunction with other technical analysis tools. Volume trends and relative strength index (RSI) complement the insights gained from the 50-day moving average. Relying solely on one indicator may lead to incomplete analysis.

Market participants also look for crossovers with longer-term moving averages, like the 200-day moving average. A crossover can confirm larger trends and reinforce trading strategies. Observing these dynamics provides a clearer picture of Nvidia’s market position.

Investors monitor any deviations from the moving average closely. Identifying when prices approach or diverge significantly from the 50-day moving average might reveal trend reversals. This approach allows for timely adjustments in investment strategies.

By understanding Nvidia’s 50-day moving average, both seasoned and novice investors gain an edge. Informed decisions rely on interpreting price movements relative to this essential indicator. Therefore, familiarity with this metric enhances engagement with Nvidia’s stock performance.

Importance of Moving Averages in Trading

Moving averages serve as crucial indicators in technical analysis for trading decisions. Investors utilize them to better understand stock price trends, where short-term price movements are essential for strategies.

Types of Moving Averages

Simple moving averages (SMAs) calculate the average price over a specific period. Exponential moving averages (EMAs) assign more weight to recent prices, making them responsive to current market conditions. Weighted moving averages (WMAs) also focus on the most recent data but with a different significance structure. Each type offers distinct insights, enabling traders to adopt various techniques in assessing stock performance.

Why 50 Day Moving Average?

The 50-day moving average provides insight into short-term price trends, serving as a benchmark for price performance. This moving average representation helps traders identify potential buying or selling opportunities. When NVIDIA’s price climbs above the 50-day average, it indicates bullish momentum. Conversely, a drop below signals bearish sentiment. Using the 50-day moving average alongside other indicators enhances trading strategies, allowing market participants to make more informed decisions about entry and exit points.

Analyzing Nvidia’s Stock Performance

NVIDIA’s stock performance reflects a dynamic interaction of various market forces. Historical data shows that the 50-day moving average has provided insight into price trends for a significant period.

Historical Data and Trends

Past performance indicates that NVIDIA’s stock often reacts to its 50-day moving average before major price shifts occur. Analysis of historical data reveals that the stock frequently maintains upward momentum when prices surpass the average. Conversely, traders observe caution when prices dip below this benchmark, indicating potential bearish trends. Patterns of moving average crossovers with longer averages, like the 200-day, signal significant market adjustments. This historical context aids investors in planning strategies based on previous trends and reactions.

Current Market Analysis

Current analysis of NVIDIA’s stock shows fluctuations near the 50-day moving average. Recent data underscores that prices hover around the average, representing indecisive market behavior. Bullish signals appear when prices consistently break above the moving average, suggesting upward potential. Awareness of changes in volume trends adds depth to the analysis, as increased activity often supports price movements. Additionally, correlation with the relative strength index clarifies market sentiment. Such comprehensive observation enables investors to fine-tune their strategies in real-time, enhancing decision-making.

How to Calculate the 50 Day Moving Average

Calculating the 50-day moving average involves a straightforward formula. First, sum the closing prices of NVIDIA’s stock for the last 50 days. Next, divide this total by 50. This calculation provides a simple moving average (SMA), reflecting the average price over that specified period.

Investors track these averages to analyze price trends. They often compare current prices to this average, allowing them to gauge bullish or bearish momentum. If the stock price consistently exceeds the moving average, it indicates a bullish trend. Conversely, prices below the average suggest a bearish sentiment.

In many cases, traders use software tools or online platforms to automate this calculation. Real-time data feeds ensure accuracy, updating the moving average as new closing prices are available.

Examining historical data reinforces the insights offered by the 50-day moving average. Many analysts observe that significant trends or reversals often coincide with movements around this average. Noteworthy changes in price around this benchmark signal possible adjustments to trading strategies.

Additionally, combining the 50-day moving average with other technical indicators enhances decision-making. For example, traders may incorporate volume trends or the relative strength index alongside the moving average. This multifaceted approach helps in identifying robust buying or selling opportunities within the stock market landscape.

Using these calculations effectively enables both experienced traders and newcomers to stay informed about NVIDIA’s stock trajectory. By interpreting price movements relative to the 50-day moving average, market participants can strategically position their trades for optimal results.

Trading Strategies Using Nvidia 50 Day Moving Average

Traders rely on NVIDIA’s 50-day moving average as a critical metric in their strategies. This average often indicates potential buying opportunities when the stock price rises above it. Bullish momentum frequently correlates with such scenarios, making it an opportune time to enter a trade. In contrast, prices dipping below the average can signal bearish sentiment, prompting caution or potentially selling.

Utilizing the 50-day moving average alongside other technical indicators enhances analysis. Combining it with volume trends allows investors to validate signals, while the relative strength index (RSI) provides further context for momentum. Crossovers with longer-term moving averages, like the 200-day moving average, enhance trend confirmation and add robustness to trading strategies.

Monitoring deviations from the moving average plays a vital role in identifying trend reversals. Significant changes around this benchmark indicate shifts in market sentiment. When an upward trend emerges, staying alert for price movements that consistently break above the average can lead to profitable trades. Conversely, quick reactions are essential when prices fall below it, as this may suggest a change in direction.

Investors can effectively calculate the 50-day moving average using closing prices from the past 50 trading days. By dividing the sum of these prices by 50, traders obtain a simple moving average (SMA). This approach to computation serves as a foundational tool for evaluating price trends and overall momentum. Using real-time software or online platforms enables accurate tracking as new data becomes available.

Ultimately, the 50-day moving average remains a vital aspect of NVIDIA’s technical analysis. It provides clear signals, helping investors position their trades for optimal results. Emphasizing this metric in trading strategies equips both expert and novice investors to navigate the dynamic stock market effectively.

NVIDIA’s 50-day moving average serves as a pivotal tool for investors navigating the stock market. By offering insights into price trends and potential buy or sell signals, it empowers traders to make informed decisions. Monitoring this average alongside other technical indicators enhances the ability to identify market movements and adapt strategies accordingly.

Understanding how deviations from the 50-day moving average can indicate trend reversals is crucial for maximizing investment opportunities. As market conditions evolve, staying attuned to this benchmark enables both experienced and novice investors to position themselves effectively. Ultimately, leveraging the 50-day moving average can lead to more strategic trading and better overall performance in NVIDIA’s stock.